Wind Power's Robust Growth in the U.S

A recent report by the U.S. Department of Energy (DOE) paints a vivid portrait of a sector experiencing robust growth, solid performance, and tantalizingly competitive pricing

In an era defined by environmental imperatives and technological revolutions, the allure of wind energy in the U.S. has never been more pronounced. A recent report by the U.S. Department of Energy (DOE) paints a vivid portrait of a sector experiencing robust growth, solid performance, and tantalizingly competitive pricing—even in the face of inflation and supply chain pressures.

"Amid the shifting economic sands, the heartland of America—the central United States—emerges as a beacon of resilience," articulates Ryan Wiser, a senior scientist with Berkeley Lab’s Energy Technologies Area. He underscores wind energy's potent economic recipe by juxtaposing its enticing prices with its wider societal impacts. "When you consider the overarching health and climate boons wind energy delivers, its value proposition becomes even more compelling," Wiser elaborates.

But let's dive deeper into the prevailing winds of change.

2019 might have been muted, but the horizon glows with promise. In 2022, the pace of new wind power deployment seemed to momentarily pause. Yet, the Inflation Reduction Act heralds a transformative future, reshaping market dynamics and setting the stage for expansive growth.

The Electric Pulse: Wind energy's footprint on the U.S. electricity tapestry is expanding. With an 8.5 GW deployment in 2022—a $12 billion investment—it now fuels over 10% of the nation's electric appetite. In regions like the Southwest Power Pool, that figure skyrockets to 38%. What’s even more astonishing? A whopping 300 GW of wind energy is queuing up for transmission interconnection.

Size Matters: As technological prowess deepens, wind turbines are reaching skyward, both in height and ambition. A decade ago, turbines with rotors spanning 115 meters were a rare sight, constituting just 1% of the landscape. Fast forward to 2022, and this has become the standard, with 98% of fresh installations brandishing such impressive rotors.

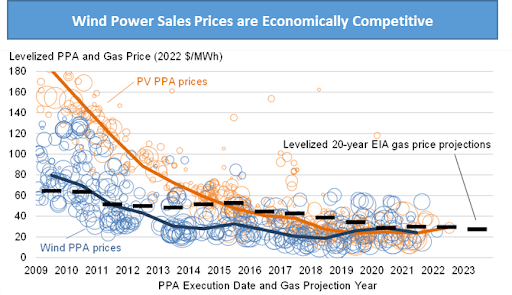

Balancing the Scales: Although wind energy prices have noticed an uptick since 2018, they remain enticing for stakeholders. Factor in federal tax support, and the prices stand toe-to-toe with solar sales and anticipated gas-fired generation fuel costs.

Riding the Market Wave: The intrinsic value of wind in power markets took a bullish turn in 2022. High natural gas and wholesale power prices augmented wind's market value, particularly in regions like New England and California.

The Cost-Benefit Dynamics: At a national average of $32/MWh, the levelized cost of wind for projects inaugurated in 2022 seems favorable. When juxtaposed with the health and climate benefits that wind energy brings to the table—valued at an astounding $135/MWh—the narrative becomes even more gripping.

Reviving the Domestic Supply Chain: The dawn of 2022 saw the domestic supply chain grappling with challenges. However, the Inflation Reduction Act infused a fresh bout of optimism. This landmark legislation has not only bolstered domestic manufacturing but has also ushered in a wave of manufacturing facilities, looking to cater to the burgeoning demand in the wind sector.

A Windy Forecast: The consensus among energy analysts is clear: the wind is set to blow stronger. Incentives embedded within the Inflation Reduction Act have recalibrated projections. Analysts now anticipate an average wind deployment of 18 GW by 2026—a marked surge from the 11 GW forecast from just a year prior.

As we stand at the cusp of a green revolution, the winds of change are palpable. If the current trends are any indication, the U.S. wind sector is not just poised for growth—it's set to soar.