New Clean Vehicle Credit Regulations

Under the new regulations (April 18th), vehicles meeting the critical mineral and battery component requirements are eligible for a $7,500 tax credit.

Check out our website, The Carbon Chronicle, and our Carbon Pricing Dashboard.

Carbon Brief

Gravitricity, UK-based energy storage specialist, forms US partnership that aims to tap $450m of Inflation Reduction Act fund for clean energy projects at coal mines

Tesla Carbon Credits Revenue increased 12% from the prior quarter’s sales, with $521 million in this first quarter compared to $467 million in Q4 2022.

Australia's first public carbon credit trading market has launched, allowing big polluters to offset their emissions. The owner of the market predicts a surge in demand, which could cause a shake-up in the country's $4.5bn carbon market.

The Clean Vehicle Credit (2023)

The Inflation Reduction Act of 2022 has brought significant changes to the Qualified Plug-in Electric Drive Motor Vehicle Credit, which is now known as the Clean Vehicle Credit. With the new tax year, several limitations apply for vehicles delivered on or after April 18, 2023. These limitations, which went into effect on January 1, 2023, are related to the vehicle’s manufacturer’s suggested retail price, the buyer’s modified adjusted gross income, and the vehicle’s battery capacity. However, it's the critical mineral and battery component requirements that have drawn attention from both consumers and manufacturers, since they alter how the tax credit is calculated and may affect the amount of the tax credit available. These requirements came into effect with the publication of the Treasury Department’s guidance document. Under the new regulations, vehicles that meet the critical mineral requirements or the battery component requirements are eligible for a $3,750 tax credit each, while vehicles that meet both requirements can receive a total tax credit of $7,500.

Battery Requirements

For a vehicle to be eligible for the Clean Vehicle Credit, the battery powering it must have a capacity of at least seven kilowatt-hours (kWh). The credit amount depends on the vehicle's compliance with certain critical minerals and battery component requirements.

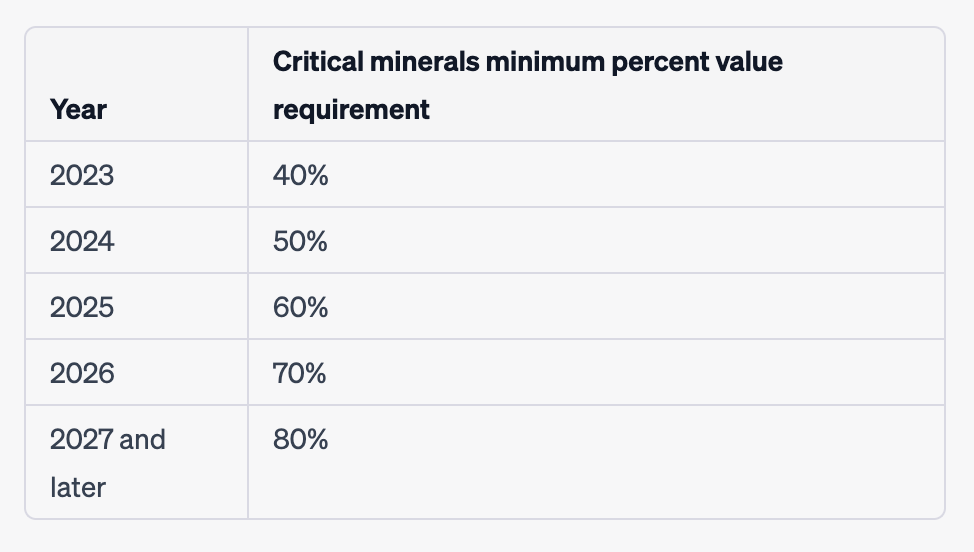

Regarding critical minerals, to be eligible for the $3,750 critical minerals portion of the tax credit, the percentage of the value of the battery's critical minerals that are extracted, processed, or recycled in the United States or a U.S. free-trade agreement partner must meet or exceed specific thresholds. These thresholds include a minimum percentage value requirement of 40% for 2023, which will increase gradually to 80% for 2027 and later.

Regarding battery components, to be eligible for the $3,750 battery components portion of the tax credit, the percentage of the value of the battery's components that are manufactured or assembled in North America must meet or exceed certain thresholds. These thresholds include a minimum percentage value requirement of 50% for 2023, which will increase to 100% for 2029 and later.

MSRP and Buyer’s Modified Adjusted Gross Income

The new limitations for electric vehicles go beyond battery capacity and extend to the vehicle’s manufacturer's suggested retail price (MSRP) and the buyer’s modified adjusted gross income (MAGI). Vans, sport utility vehicles, and pickup trucks cannot have an MSRP above $80,000, while all other vehicles must not exceed $55,000. The MSRP, which can be found on the vehicle’s window sticker, includes any trim, options, or accessories for the particular vehicle and excludes the destination fee and dealer-provided options and accessories. Thus, individuals looking to take advantage of the tax credit need to ensure that they choose a vehicle that meets these requirements.

However, even if a vehicle meets the MSRP requirement, a taxpayer's eligibility for the tax credit may still be limited by their modified adjusted gross income (MAGI). According to the current tax regulations, only individuals with a MAGI below certain thresholds are eligible for the tax credit. For instance, joint filers must have a MAGI below $300,000, while head-of-household filers must have a MAGI below $225,000, and all other filers must have a MAGI below $150,000.