Brief History

Nature Debt Swaps, also known as Debt-for-Nature Swaps, are a concept that has been gaining traction recently, have their roots in the 1980s when developing countries were grappling with mounting debt burdens. At the time, environmental concerns were not as prominent, and the debt crisis was the main focus of global attention. These struggling nations, faced with high levels of debt, often turned to environmentally degrading activities to generate income, as their export economies were primarily based on natural resources.

However, with the growing awareness of the impact of climate change and the loss of biodiversity, many have started to see the connection between debt repayment and the destruction of the environment. The idea of swapping debt for nature conservation efforts emerged in the 1990s, and over the years, several initiatives have been launched to promote such swaps. The United States is by far the largest originator of bilateral debt-for-nature swaps. It is responsible for 64 per cent of the total debt forgiveness and generating 44 per cent of the total conservation funding. Nature debt swaps are seen today as one of the most fastest growing mechanisms to tackle two of the biggest challenges of our time: unsustainable debt and environmental degradation.

How do they work?

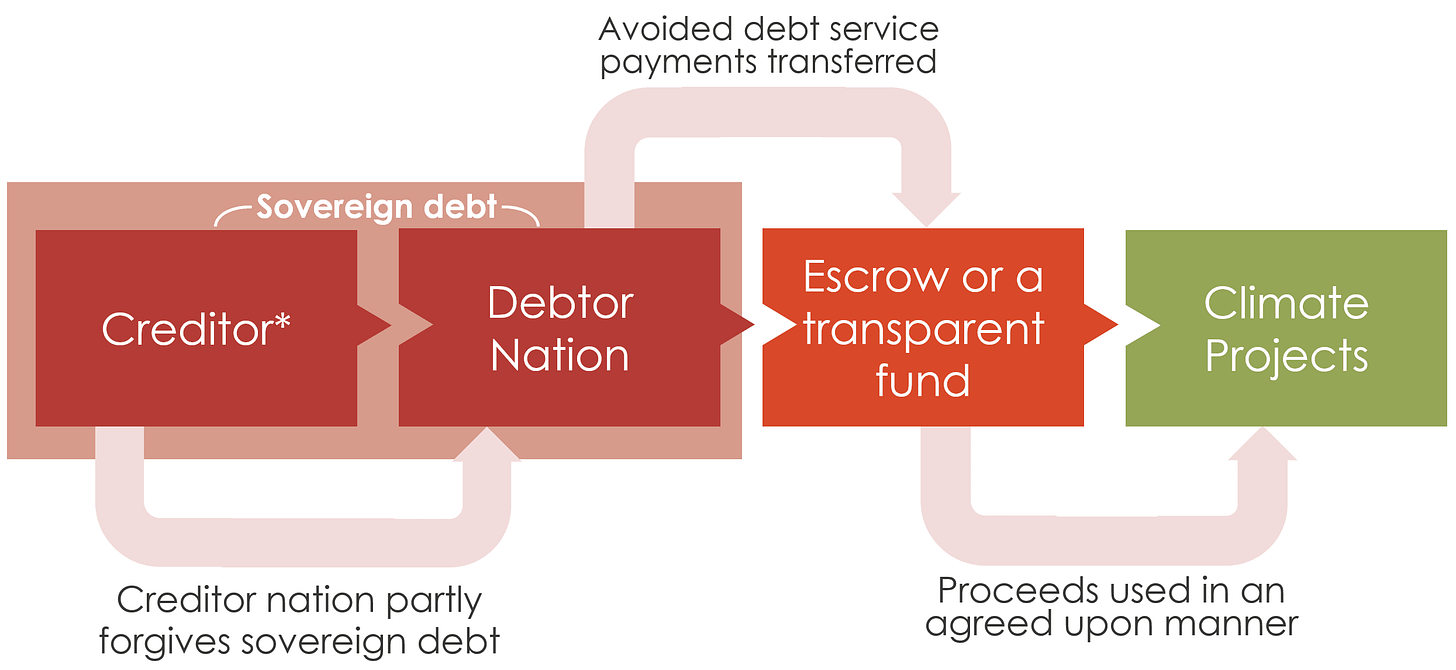

Source: Climate Policy Initiative

While the concept may appear simple, swaps are complex financial transactions that can include various parties such as commercial banks, private foundations, international organizations and of course, the respective indebted and creditor governments.

To implement a nature debt swap, creditors need to agree to reduce the debtor nation's debt burden. To achieve this goal, a combination of methods can be used. One common method is to convert a portion of the debt into the debtor nation's local currency. This can make it easier for the country to repay the debt, as they will not have to worry about fluctuations in exchange rates. The creditors might also choose to lower the interest rate of the debt or write off debt completely for developing countries that are struggling to meet their debt obligations. Besides the environmental affects, this can be beneficial for both the creditor and debtor, as it allows the creditor to clear some or all of the debt from their books and the debtor reduces their overall debt burden.

Recent Developments in Nature Debt Swaps

Ecuador is currently working on a debt-for-nature swap worth $800 million aimed at conserving the Galapagos. This initiative will enable the nation to address its financial obligations while also protecting its natural resources, which are key to its tourism industry and overall economic growth.

Sri Lanka is currently facing an economic and political crisis due to its inability to repay its loans, which has led to a significant debt burden of about $45 billion. While a debt-for-nature swap may provide some relief, the country is facing protests over shortages of food, fuel and medicine.

Zambia has received a debt-for-nature swap outline from the World Wildlife Fund that could provide up to $1 billion for green projects. The success of the swap will depend on the specific terms and conditions of the agreement, as well as the ability of the country to effectively implement and manage conservation projects.

Portugal and Cabo Verde are in the early stages of negotiating a debt-for-nature deal that will restructure the debt of the West African country and its payment to the European creditor. This is a positive development for Cabo Verde, which faces significant environmental challenges, particularly in terms of water scarcity and deforestation.

Other reported interest include Argentina, Eswatini, Pakistan, Kenya and many others.

While nature debt swaps are a promising tool, they are not without their challenges. One of the biggest obstacles is finding the right balance between debt relief and conservation investments. Additionally, it can be difficult to determine which conservation projects will have the greatest impact and ensure that the funds are used effectively.

By aligning financial interests with environmental goals, these swaps offer a promising approach to promote conservation while supporting economic development. As more countries and creditors explore these arrangements, the potential for a sustainable future for both people and the planet grows brighter.

How Effective are they?

A recently published journal titled: "The United States, Bilateral Debt-for-Nature Swaps, and Forest Loss: A Cross-National Analysis", has shed light on the potential benefits of nature debt swaps in terms of forest protection. The study focused on two projects that were funded by a United States debt-for-nature swap signed in 2002, which resulted in the cancellation of $14.3 million of Peruvian debt and generated $10 million for conservation efforts.

According to the study, there is consistent evidence to suggest that United States bilateral debt-for-nature swaps are associated with lower rates of forest loss, which was observed across both wet and dry forests. These findings contradict much of the existing cross-national research and support the theoretical arguments regarding the effectiveness of the mechanism.

While the findings of the study on United States bilateral debt-for-nature swaps are promising, it is important to note that the effectiveness of nature debt swaps may vary depending on the specific program and country involved. Therefore, it is not appropriate to assume that these results can be widely generalized. Nonetheless, these results have important implications for policy makers and environmental advocates, as they highlight the potential for debt-for-nature swaps to be used as a tool to protect natural resources and reduce deforestation, particularly in developing nations where economic growth and resource extraction can threaten forests and other natural resources. By recognizing the benefits of nature debt swaps, we can begin to explore innovative solutions to the pressing environmental challenges we face today, and work towards a more sustainable future.