Lack of Finance as a Barrier to Climate Action

Insufficient Financing and Lack of Incentives Hinder Climate Action: Understanding the Role of Public Finance and the Need for Increased Adaptation Funding.

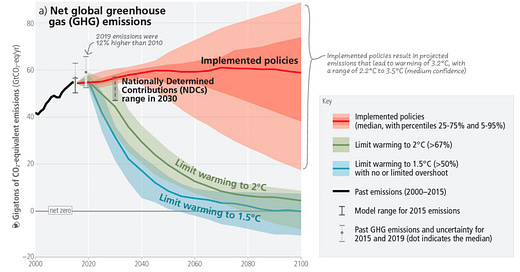

(Image from 2023 IPCC Report)

(Current subscribers can now access the PDF resource by accessing Carbon Trading Chat on the Substack app)

Check out the article on Carbon Chronicle and check out our carbon pricing dashboard.

Insufficient financing and a lack of incentives have been identified as key barriers to the implementation of climate action. Despite the urgent need for both mitigation and adaptation, financial flows have remained heavily focused on mitigation, and are unevenly distributed across regions and sectors. The Intergovernmental Panel on Climate Change (IPCC) has modeled investment requirements for different scenarios of limiting warming to 2°C or 1.5°C:

According to their analysis, the average annual investment requirements between 2020 to 2030, are estimated to be three to six times greater than current levels.

Efforts are continually not meeting up to par as the UNFCCC reported: public and mobilized private climate finance flows from developed to developing countries in 2018 were below the collective goal of mobilizing USD $100 billion per year by 2020. This lack of sustainable financing has hindered meaningful mitigation and implementation projects.

Public Sector

The world needs to significantly increase its investment in climate action in the next decade to meet the Paris Agreement goals. Meeting the investment requirements for climate action will require a mix of public and private financing, as well as innovative financing mechanisms. Public finance especially plays a crucial role in enabling both adaptation and mitigation measures. Public funding can be used to support research and development of new technologies, finance infrastructure projects, and provide grants or subsidies to incentivize private sector investment in climate action.

Public finance can also play an essential role in mobilizing private finance by addressing real and perceived regulatory, cost, and market barriers. Public-private partnerships are one way to leverage public finance to attract private investment in climate projects. For example, a public agency can provide funding for a renewable energy project, reducing the project's risk and making it more attractive for private investors. Adaptation funding primarily comes from public sources, such as international climate finance mechanisms like the Green Climate Fund, as well as domestic government budgets.

In addition to direct financing, public mechanisms and finance can also play a role in leveraging private sector finance. Many countries have already implemented carbon pricing mechanisms, including the most notable carbon markets: EU ETS and the California Cap-and-trade program. However, there is still a need for more countries and regulatory bodies to develop their own carbon markets or other carbon pricing mechanisms. The implementation of carbon pricing can provide a powerful incentive for emissions reductions and can also generate revenue for governments to invest in climate mitigation and adaptation measures.

Adaption Finance

Adaptation finance refers to the financial resources required to implement measures to help societies and ecosystems adapt to the impacts of climate change. These measures may include building sea walls, improving irrigation systems, and investing in drought-resistant crops, among others.

Unfortunately, the current global financial flows for adaptation are insufficient to meet the needs of developing countries. While there are some private sources of finance for adaptation, the majority of adaptation finance comes from public sources, including government budgets and international aid. These sources of finance are often limited and may not be enough to meet the needs of developing countries, which are expected to be hit hardest by the impacts of climate change.

There are also widening disparities between the estimated costs of adaptation and the finance that has been allocated to adaptation. According to a report by the UNFCCC, adaptation finance needs are estimated to be higher than those assessed in previous reports. This means that the current levels of adaptation finance are insufficient to meet the actual needs of communities and ecosystems that are vulnerable to climate change.

Enhanced mobilization of financial resources is essential for the implementation of adaptation measures and to reduce adaptation gaps. This requires a coordinated effort between developed and developing countries, as well as between public and private sectors. One potential solution is for developed countries to provide more financial support to developing countries through international aid and other mechanisms. This can help to ensure that developing countries have the resources they need to implement effective adaptation measures. Another solution is to leverage private sector finance for adaptation. This can be done through mechanisms such as green bonds, which allow investors to finance climate-friendly projects, including adaptation measures.