EU's Carbon Cost Crunch: The End of Free Lunch for Industries

As Regulatory Ambitions Soar, European Industries Must Rapidly Adapt or Face Soaring Carbon Costs that Could Reshape the Competitive Landscape

Unpacking the Regulatory Quake

Last May, a seismic shift occurred in European environmental policy. The EU updated its Emissions Trading System (EU ETS), the cornerstone of the Union’s efforts to cut industrial greenhouse gas emissions. Published in the Official Journal of the European Union, the overhauled policy outlines significant changes that will phase out free carbon emission rights, known as EU Allowances (EUAs), by 2034. But that's not all; a new levy, the Carbon Border Adjustment Mechanism (CBAM), aims to level the playing field for EU businesses and encourage global emissions reductions. The clock is ticking, and industries across the spectrum are scrambling to decode the new language of carbon cost.

Starting in 2026, CBAM will incrementally take effect, reaching its full operational status by 2034. On the other side of the equation, free EUAs will be phased out by the same year. Intersecting these regulations is a set of ambitious targets: industries covered by the EU ETS must slash their collective emissions by 62% by 2030, compared to 2005 levels. To make this more challenging, the total number of EUAs will shrink year-on-year, starting with a 4.3% reduction from 2024 to 2027 and a further 4.4% reduction from 2028 to 2030.

With provisions like Article 10a’s mandatory energy audits, the pressure is on. Companies that fail to implement the audit’s recommendations promptly could see their free EUA allocation decrease even further. Adding fuel to the fire, the current political climate in the EU is agitating for stronger green policies. Whether the next Commission leans center-right or green-left, the appetite for environmental regulation shows no sign of waning.

What It Means for the Bottom Line

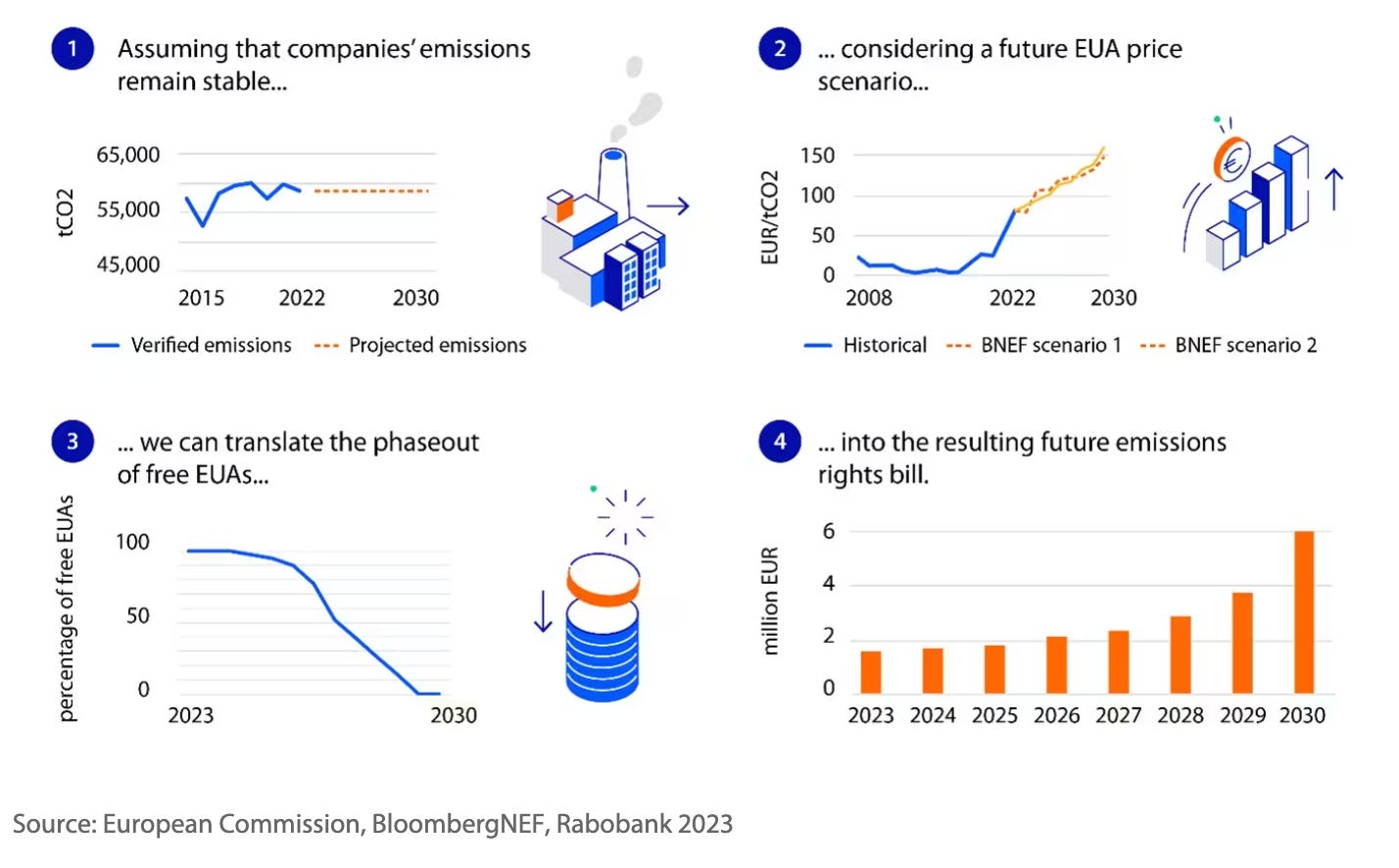

The implications of these regulations for industries cannot be overstated. Current forecasts indicates that the cost of carbon emissions, currently shouldered partly by free EUAs, will skyrocket between 2.5 to twentyfold depending on the sector. To remain competitive, companies need to prepare for this paradigm shift and understand the dynamics driving these price increases.

So, what does it all mean for the bottom line? Let's unpack the implications in greater detail.

Cost of Emission

Under the new regulations, the days of banking on free EUAs to offset carbon costs are numbered. As the policy phases out these allowances, companies should brace for a considerable uptick in operating expenses. Our analysis reveals a substantial range in cost increases, from 2.5 times to an eye-popping twentyfold, depending on the sector. This means that, for some companies, the cost of carbon emissions could become one of their most significant expenses, dwarfing even labor or raw material costs in some cases.

Reassessing Profit Margins and Competitive Edge

The phasing out of free EUAs can't be viewed in isolation—it has to be seen in the broader context of a company's profit and loss statement. For companies operating on thin margins, the higher carbon costs could tip the scales from profit to loss. For others, it might erode competitiveness, making their products more expensive compared to those from regions without such strict carbon regulations.

Capital Expenditure

It's not all doom and gloom, however. The stark rise in emission costs will make capital investments in green technology increasingly attractive. The prospect of higher carbon costs could change the ROI calculus for green tech, making it far more appealing to invest in carbon-reducing technologies now rather than later. Companies making early transitions could even offset the increases in carbon costs by benefiting from operational savings down the line.

Liquidity and Cash Flow Considerations

The additional costs aren't just a concern for the distant future. Businesses need to think about their cash flow requirements as they start to pay more for their carbon allowances. Some might need to negotiate new terms with creditors, or even rethink their dividend policies to retain more cash for these impending costs.

Risk Management and Hedging Strategies

With the carbon market becoming a focal point, financial risk management strategies will also need to adapt. The volatility in the carbon market might require companies to adopt new hedging strategies, potentially dealing with carbon allowances as they do with other commodities, securing future prices to mitigate financial uncertainty.

Investor and Stakeholder Relations

Investors are becoming increasingly savvy about environmental considerations. A company's approach to the changing carbon costs will not only affect its bottom line but also its attractiveness as an investment. Transparent, well-articulated strategies for dealing with the increase in carbon costs will be crucial in maintaining investor confidence.

While this landscape might seem like a minefield, early action can serve as a shock absorber. Companies with a well-executed strategy could use their free EUAs to finance decarbonization investments. Late movers risk facing a costly and narrow path to compliance. The EU ETS and CBAM aren’t merely regulatory hurdles; they represent the EU's intent to transform its industrial landscape. The interaction between these two tools, alongside other provisions like the Net-Zero Industry Act and the Green Deal Industrial Plan, shows how committed the EU is to a cleaner, greener future.

This regulatory overhaul isn't a storm to be weathered; it's the new climate of doing business in the EU. The message is clear: Adapt to the changing carbon cost landscape or risk being left behind. Industries must rapidly reassess their carbon strategies, focus on long-term sustainability, and above all, act now. The cost of inaction could be their very survival.