Europe's Carbon Pricing: A Tale of Economic Costs and Benefits

Europe's Quest to Curb Emissions Without Stifling Growth

The climate crisis necessitates innovative solutions, and carbon pricing policies have emerged as pivotal tools for reining in emissions. The European landscape, where the stakes are high and the game constantly evolving, offers insights into the economic ramifications of these policies. Diving into a new study by Känzig and Konradt, we elucidate the balance of environmental gains versus economic pains.

The Dual Arsenal against Climate Change

Two significant instruments frame Europe's combat strategy against climate change: the EU Emissions Trading System (EU ETS) and national carbon taxes. While the EU ETS, covering over 40% of the bloc’s emissions, functions as the backbone, several European countries amplify their efforts with national carbon taxes, specifically targeting sectors not embraced by the EU ETS.

Känzig and Konradt's research, adopting a robust empirical framework, underscores a fundamental truth: both these tools do curb emissions. Yet, a closer scrutiny reveals stark differences in their economic footprints.

Economic Outcomes: Pricey Policies?

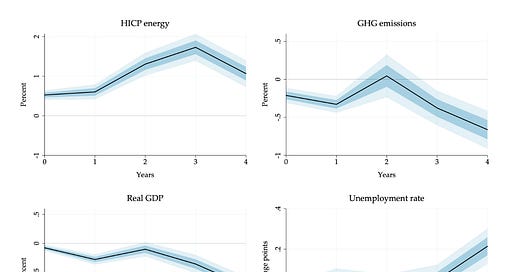

Graph Above: The effects of an increase in EU ETS carbon prices (Diego Känzig Maximilian Konradt)

The EU ETS, one of the globe's most expansive carbon markets, exacts a hefty toll on the economy. An upsurge in carbon prices results in higher energy costs, dwindling outputs, inflated consumer prices, and escalating unemployment. Essentially, while emissions wane, the economy wavers.

Contrastingly, national carbon taxes, despite their narrower ambit, present a more benign economic picture. Here, the surge in energy prices is restrained, and there's barely a ripple in consumer prices or unemployment.

So, what's behind these differential impacts?

Four Factors Decoding the Discrepancy

Fiscal Policies and Revenue Recycling: Unlike the broad EU ETS, national carbon taxes often operate in tandem with fiscal reforms. Countries that reinvest carbon tax revenues tend to buffer economic shocks better. Such a revenue reinvestment strategy not only alleviates economic downturns but achieves emission reductions sans compromise.

Sectoral Scope: The EU ETS encompasses the most carbon-guzzling sectors. As these behemoths are prone to transfer a major chunk of emission expenses to consumers, they invariably hike prices. National carbon taxes, with their more selective targeting, generate less pronounced price fluctuations.

Simultaneous Price Changes and Spillovers: The EU ETS's vast expanse means synchronized price modifications across countries, nullifying any possible offsetting effects. The outcome? Only the ETS prices make a tangible dent in overall EU emissions.

Monetary Policy Intricacies: Carbon policies that affect consumer prices might spur responses from monetary institutions like the ECB, possibly intensifying economic downturns. National carbon taxes, due to their minimal price perturbations, don't trigger similar reactions.

While the EU ETS prescribes a uniform carbon price change, the fallout varies, contingent on unique country characteristics. The allocation of free emission certificates and market concentration in the power sector shape these disparities. Notably, the poorest member countries, with a lion's share of free allowances, are shielded from severe economic repercussions. Meanwhile, countries in the middle of the income hierarchy bear the brunt.

Europe's carbon pricing experiment serves as a microcosm for the globe. While these policies undeniably slash emissions, they entail economic costs unevenly distributed across regions. The key takeaway? Recycling carbon revenues emerges as a prime mechanism to temper the adverse economic impacts of carbon pricing. As nations strategize, understanding the intricate interplay of sectoral dynamics and fiscal policies becomes paramount.

In the end, as the world grapples with the climate conundrum, deriving nuanced insights from Europe's endeavors could be the key to crafting a sustainable, equitable future.