As we approach the end of the year, the European Union Allowance (EUA) market has been under the substantial influence of weather patterns and gas developments. These factors have collectively driven the EUA benchmark contract to a new 14-month low, underscoring the intricate interplay between environmental conditions, energy supply, and carbon trading dynamics.

Weather and Gas as Dominant Market Drivers

The EUA market's downward trajectory has been primarily shaped by weather-related influences and gas market movements. With the quarterly options expiring with minimal impact, speculators were able to roll most of their short positions ahead of the December 2023 expiry without catalyzing a significant rebound. This strategic move removed a potential bullish risk from the market, illustrating the nuanced tactics employed by market players in response to evolving conditions.

Power Market Dynamics: The Role of Renewable Energy

The power market has also reflected these changes, with spot prices declining over the past two weeks. This decrease is attributable to increased wind and hydro generation, coupled with moderate energy demand. Notably, a robust wind event is anticipated around Christmas, potentially leading to negative spot prices, a phenomenon that underscores the growing impact of renewable energy sources on market dynamics.

Short-Term Price Trends and Influences

Looking at the short-term developments, day-ahead prices have seen a notable decrease since early December, averaging €84.38/MWh in North-West Europe. This 14.91% week-on-week drop has been influenced by milder and windier conditions and is supported by lower fuel costs.

On the demand side, there has been a significant reduction, thanks to temperatures slightly above seasonal averages. However, intermittent cold episodes have caused sporadic increases in demand. Supply-wise, renewable energy output, particularly from hydro and wind sources, has been robust. German wind generation has played a key role in stabilizing prices, with outputs hovering around 20GW. Additionally, a gradual increase in French nuclear output, reaching peaks of 48GW, has contributed to the reduced need for thermal power plants.

Looking Ahead: Weather Forecasts and Market Implications

The week ahead is expected to be characterized by extremely windy conditions, with temperatures warmer than the long-term seasonal averages. Wind generation in Germany is anticipated to peak at approximately 48GW on the 21st of December. The combination of low demand during the Christmas holidays and high wind generation could lead to negative prices in some hours, particularly around the 24th and 25th of December.

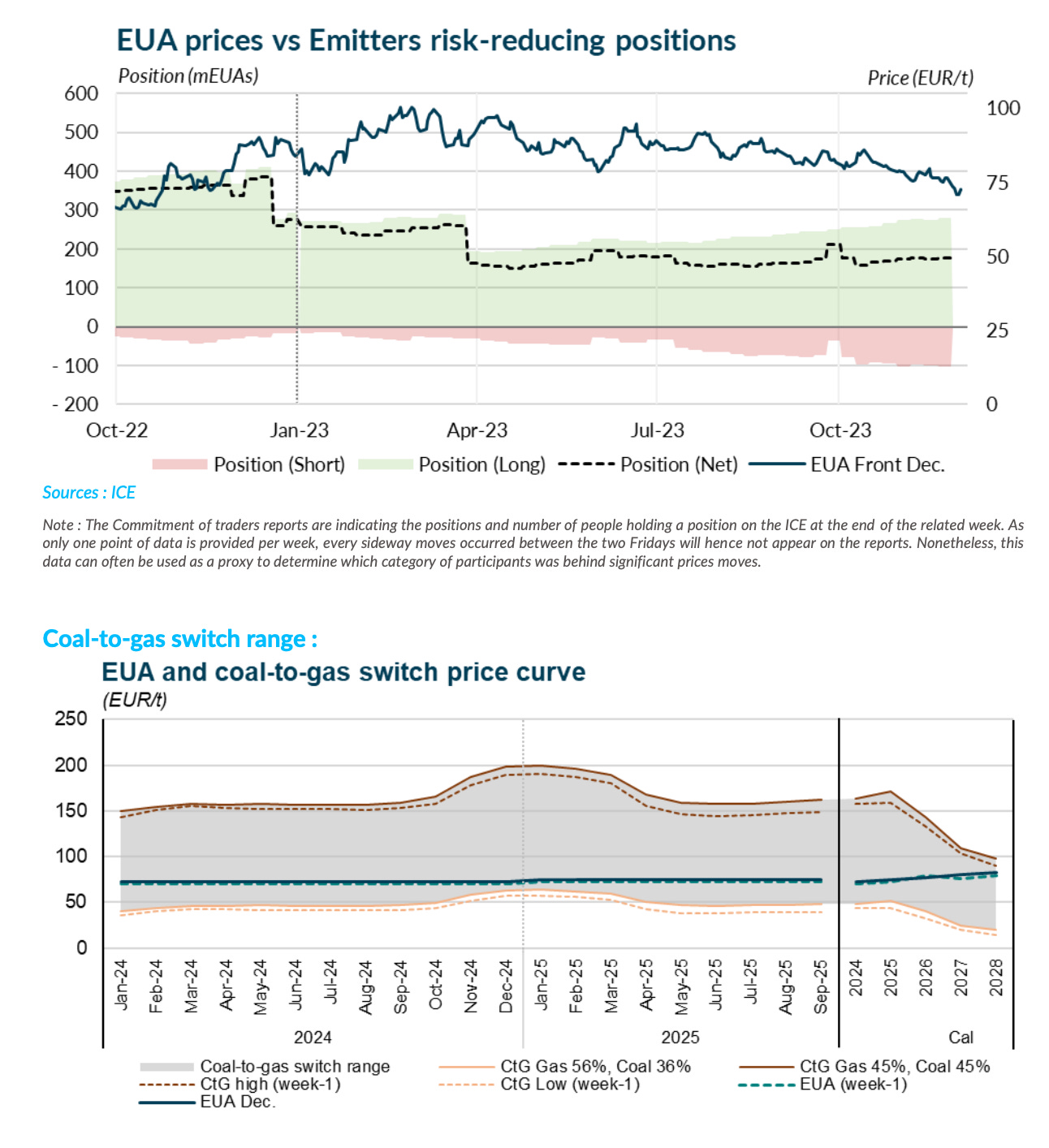

There have been more long positions than short positions, indicating a general expectation of rising EUA prices or a hedging strategy by emitters.

The stable or slightly decreasing trend in the net position suggests that while optimism remains, there's caution in the market, possibly due to external economic or policy factors.

The EUA price remains relatively stable, with some fluctuations. Stability in the price of carbon credits is important for planning and budgeting for companies that are required to offset their emissions.

The curves suggest that the price at which switching from coal to gas becomes favorable is variable, depending on the relative prices of coal, gas, and EUAs.

In 2024, the switch range is quite broad, suggesting a more volatile market where small changes in fuel prices or carbon prices could make a significant difference in the generation mix.

Towards the end of 2025, the range narrows, indicating a more stable prediction where gas becomes consistently more favored over coal for power generation, likely due to higher EUA prices making coal more expensive.

Fundamental Outlook for 2024: Political Risks and Market Trends

As we look towards 2024, the fundamental outlook appears somewhat depressed, with rising political risks potentially influencing market dynamics. Although a temporary rebound in EUA prices is possible, should there be unexpected cold or calm weather forecasts or gas supply issues, EUAs are likely to hover around, if not below, €80/t. This trend is primarily influenced by the Fit for 55 cap adjustment in January, which is expected to keep the yearly balance relatively short.