EUA and Gas Correlation Dominates Carbon Market Dynamics Amid Geopolitical Instabilities

The Interplay of Gas, Carbon, and Market Speculation

A Pivotal Week for the Energy Sector

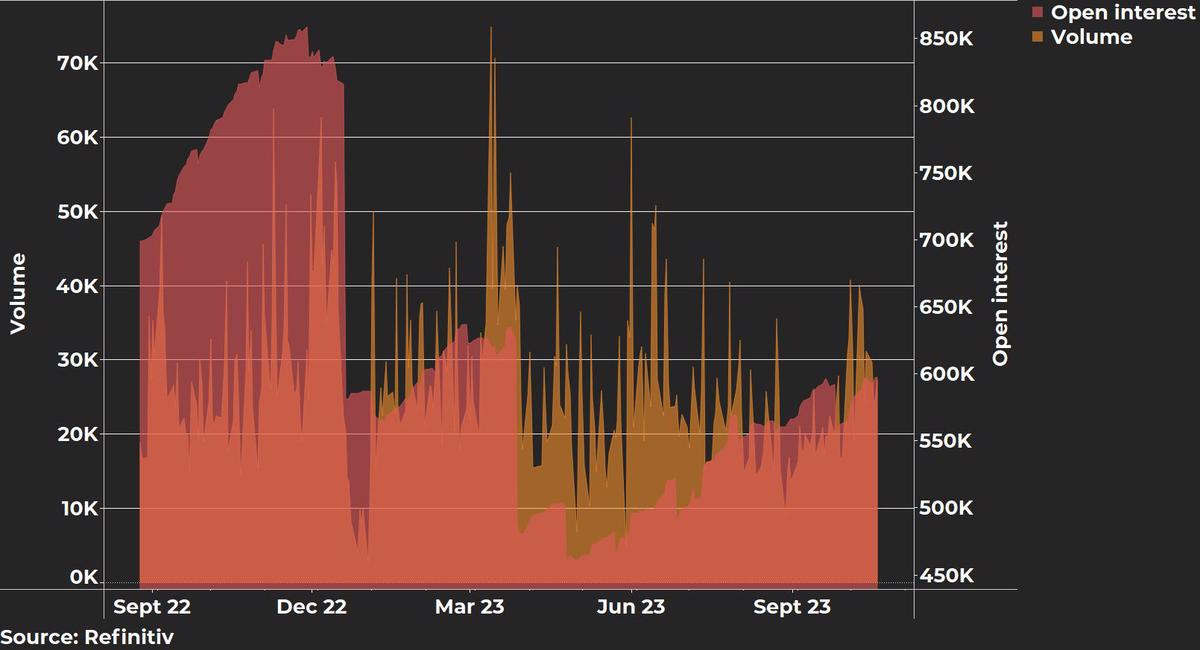

The past week presented a tumultuous landscape for the Dec23 EUA contract, with a marked correlation between EUA and gas prices. Notably, the pronounced bearish pressures engulfing gas markets directly influenced the EUA trends. Amidst these complexities, the Commitment of Traders (CoT) report divulged a significant shift: funds curtailed their net short positions by over half, leaving market observers pondering on the implications for future EUA demand.

Dissecting the Price Movements

Kickstarting the week, Monday saw the Dec23 EUA contract conceding to a bearish day, with a close at EUR 83.35, marking a 3% dip from the prior Friday. This trend persisted, with the subsequent day showcasing a pattern eerily reminiscent of Monday's trajectory, even as rumors of pipeline hitches in the Baltic Sea momentarily buoyed the benchmark contract. Still, the culmination of the day witnessed a 1% decrement, settling at EUR 82.55.

Keep reading with a 7-day free trial

Subscribe to Carbon Trading to keep reading this post and get 7 days of free access to the full post archives.