Brazil's Solar Revolution

Brazil's Net Metering Policy has Spurred Rapid Growth in Distributed Generation Solar Capacity, with Over 1.8 million PV Systems Installed Across the Country.

Stay informed and make informed decisions with Carbon Chronicle's comprehensive resources, including breaking news and articles, a Carbon Pricing Dashboard, and tools such as the Battery Policies and Incentives Search, Carbon Glossary, Vehicle Emissions Calculators, and US Electricity Sources and Emissions Tool. Check it out at carbonchronicle.com.

Solar distributed generation capacity in Brazil is growing rapidly

Brazil’s solar distributed generation sector has undergone an impressive growth trajectory since the implementation of net metering policies in 2012. As of March 31, 2023, more than 1.8 million renewable distributed generation systems have been installed in Brazil, predominantly consisting of solar photovoltaic panels, with a total capacity of approximately 19 GW, according to the Brazilian Electricity Regulatory Agency (ANEEL).

Distributed generation is a decentralized system that allows power to be produced near the point of use, such as solar arrays on the rooftops of homes and businesses. This contrasts with centralized generation, where power is generated at a plant and transported over long distances via power lines. In Brazil, solar photovoltaic dominates the distributed generation sector, making up 99% of the country’s total distributed generation capacity, with small hydroelectric and wind accounting for the remaining 1%.

ANEEL’s net metering policy, initially introduced in 2012, allowed small generators with up to 1 MW of capacity using hydro, solar, biomass, wind, and qualified cogeneration of renewable sources to qualify for net metering. In 2015, ANEEL expanded the policy to increase the maximum allowed capacity to up to 3 MW for small hydropower units and up to 5 MW for other qualified renewable sources, including solar.

The policy allows qualified generators to sell surplus electricity back to Brazil’s national grid in exchange for billing credits. Under this structure, net-metering customers can generate credits on days when they generated more electricity than they consumed.

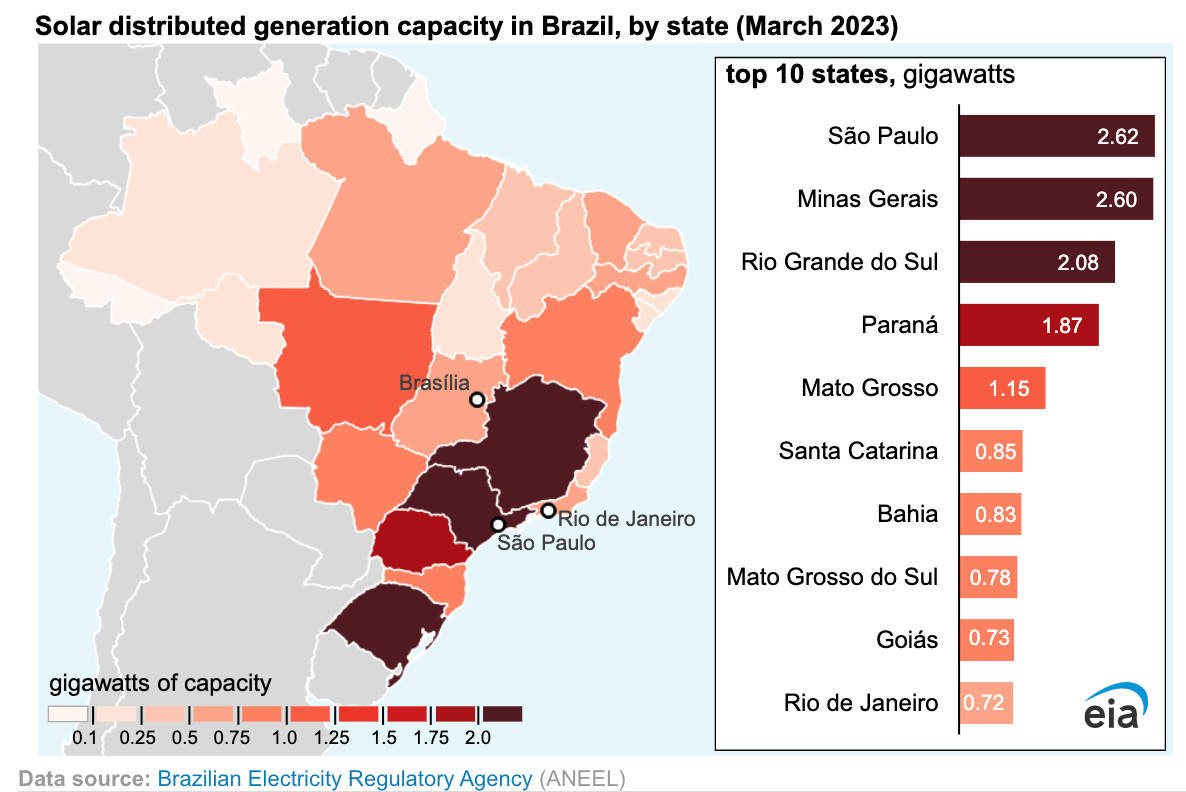

The states with the highest distributed solar capacity in Brazil are located in the South and East regions of the country, with São Paulo (2.62 GW), Minas Gerais (2.60 GW), Rio Grande do Sul (2.08 GW), and Paraná (1.87 GW) leading the way. São Paulo, which has a larger population and better economic conditions, recently surpassed Minas Gerais in solar distributed generation capacity, indicating its potential for further growth.

As of April 20, 2023, there were over 1.8 million distributed-generation PV systems connected to the Brazilian grid, providing electricity to 2.4 million consumer units across 5,526 municipalities. Solar photovoltaic technology dominated the distributed generation sector, accounting for 20.186 GW of the total 20.444 GW of capacity. Small hydroelectric and wind contributed the remaining 258 MW.

Firms, globally, are taking notice as well. Chinese battery and electric vehicle manufacturer, BYD Company Ltd (HKG:1211), has revealed plans to expand its logistic centres in Brazil. The expansion will allow the company to increase its storage capacity for complete solar kits to 1.5 GW from 1 GW per year. BYD’s expansion plan includes three new logistic centres, which will be located in the Northeastern, South and Mid-West regions of Brazil. This will allow the company to increase its delivery speed and cut logistical time in half.

According to the sales director at BYD Energy, Marcelo Taborda, the company recognizes the importance of timely delivery, especially when it comes to spare parts and installations, which involve an investment with an expected return. The market generally takes 30 to 45 days to deliver. However, BYD’s expansion will allow the company to reduce this delivery time without compromising on quality. Each of the new facilities will have the capacity to store an average of 20 MW of the firm’s mono and bifacial photovoltaic modules, with capacities varying from 450 W to 670 W. BYD is currently the only company in Brazil to commercialize a complete solar installation kit featuring panels, storage systems, and inverters. The expansion of BYD’s logistic centers in Brazil is an indication of the growing demand for solar energy in the country.

Hotel sector is important sales channel for solar industry in Brazil.

The hotel sector has emerged as an important sales channel for the solar industry in Brazil, particularly for solar thermal solutions. In 2021, the solar thermal sector experienced record-high sales, increasing by 28% compared to the previous year. This growth can be attributed to increased investment in construction and infrastructure, as well as the significant rise in electricity prices due to power supply shortages in Brazil.

As hotels and other commercial properties continue to seek ways to reduce their energy costs and carbon footprint, solar thermal systems have become a popular solution. These systems use the sun’s energy to heat water, which can then be used for space heating, pool heating, and hot water supply, among other applications. By adopting solar thermal systems, hotels can reduce their energy bills and decrease their reliance on fossil fuels, while also benefiting from long-term cost savings.

The Brazilian hotel industry has been particularly receptive to solar thermal solutions, with many hotels installing these systems to meet their energy needs. As a result, solar heating for the hotel sector has become a key sales channel for the solar industry in Brazil, contributing to the sector's overall growth.